This article explains how to complete the initial setup and application process required before using Tap Inspect Payments. If you are looking for general information About Tap Inspect Payments or Using Tap Inspect Payments your may want to read those first.

Before You Begin

You must currently be an active Tap Inspect subscriber located in the United States and using a United States bank to use Payments.

There are a few tasks that should be completed before you set up Tap Inspect Payments. By doing these tasks first, the process will be much simpler and take much less effort. Many of these tasks are part of the initial Scheduling and Automation setup.

- Complete Your User Profile

- Complete Your Company Profile

- Enable Scheduling

- Enable Invoicing

- Verify you have an active Tap Inspect subscription

- Collect business, personal, and business owner(s) information

- Collect banking and account information for deposits of payments

Once you have completed these tasks you will have everything you need to complete the Tap Inspect Payments setup and application process.

To get started, sign into your Tap Inspect web account and go to the Settings menu. Then tap on Payments.

Complete Application

You will need the business, business owner, and banking information to complete the application. Due to the confidential information needed to complete the application you may want to wait to begin the process until you have it all available.

The information from your User Profile and Company Profile will be automatically entered for you. This is to save time and effort but be sure to check that information if you have put standard information in parts of your profile.

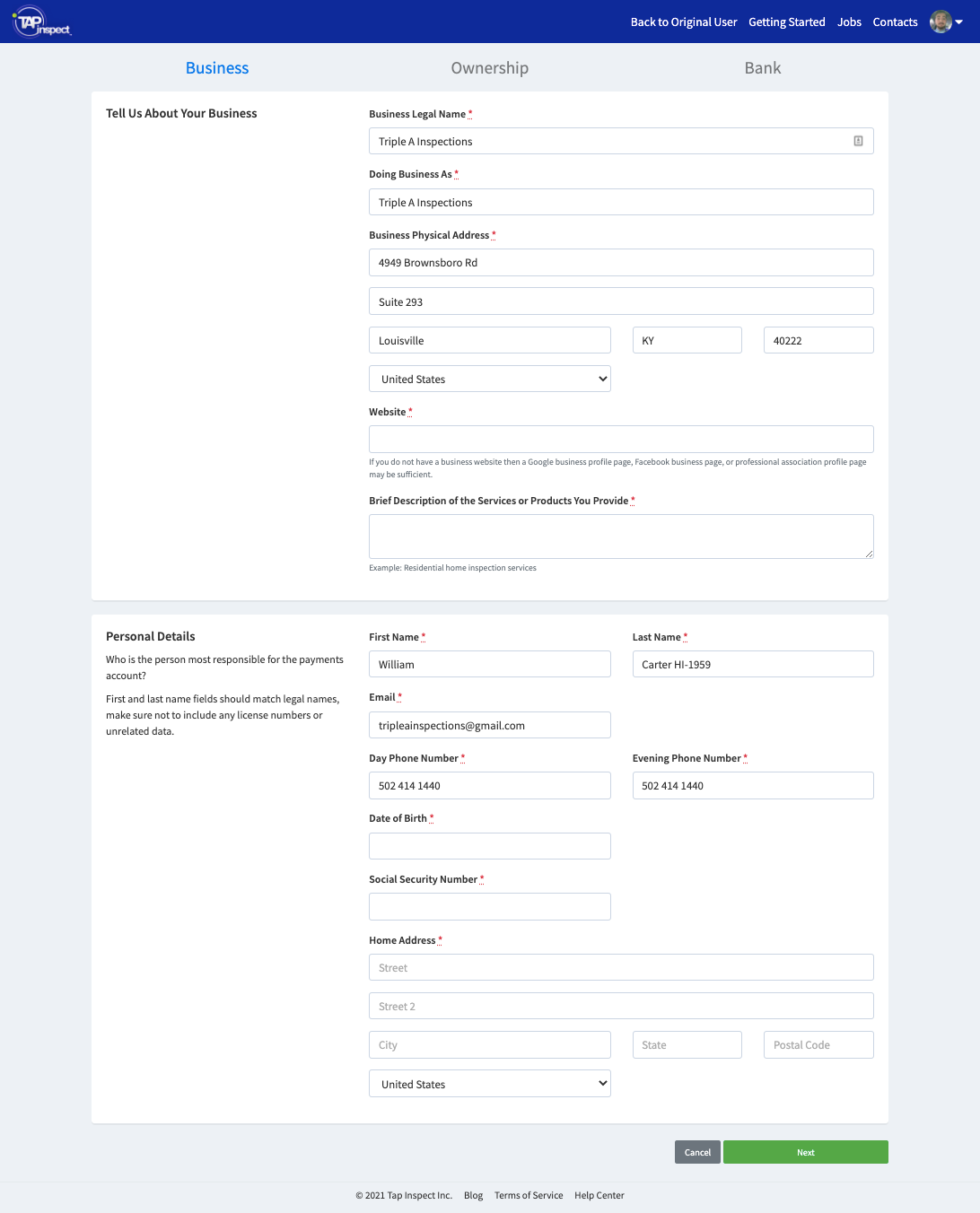

Business & Personal Information

Tell us about your business and who is the person most responsible for the payments.

This may contain 'doing business as' or DBA information. If your business is owned by a different legal entity, enter that information in the Ownership section in the next step.

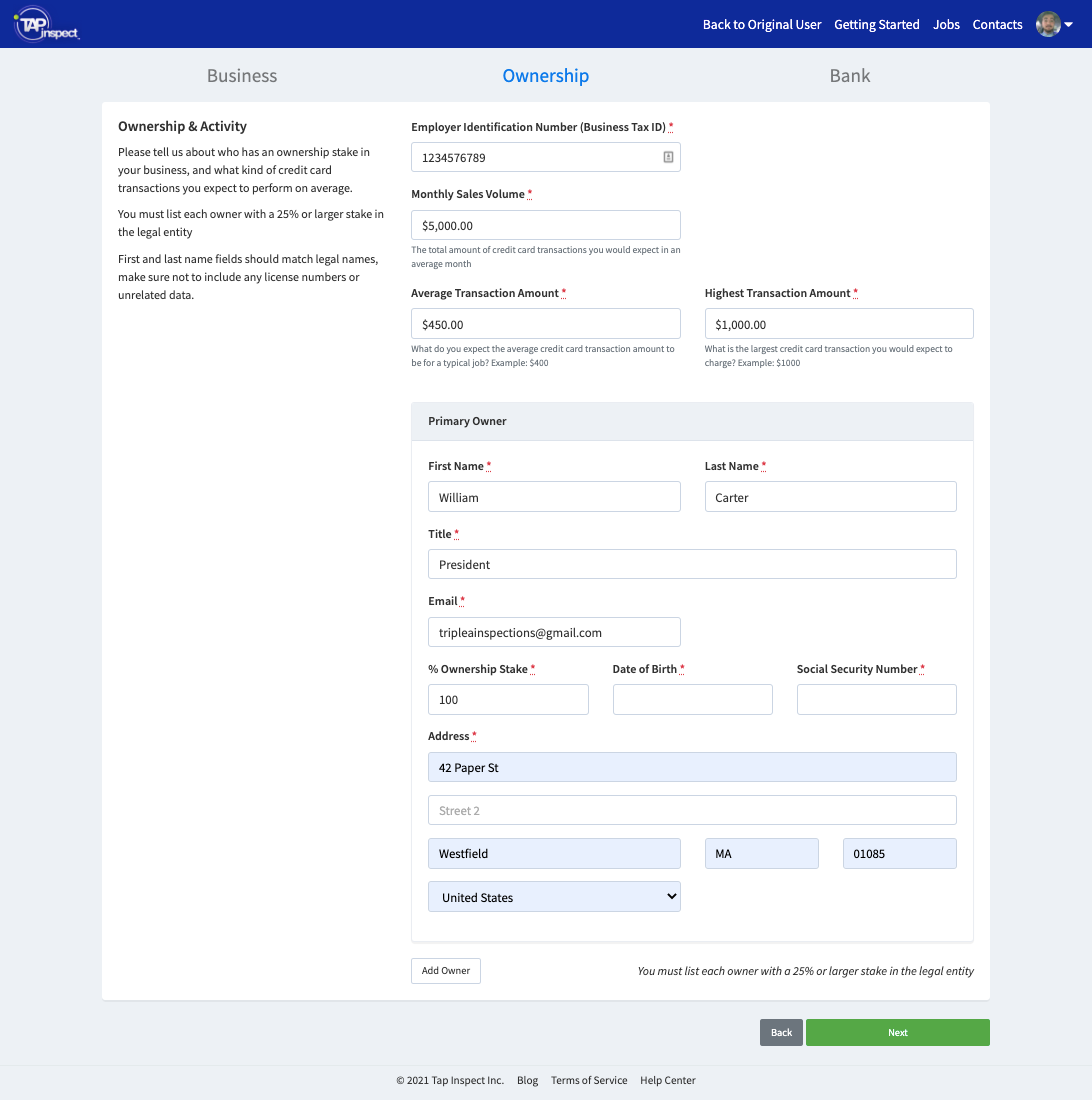

Ownership

Tell us about your business' legal entity and any business owner with a 25% or more stake in the business.

For most small or medium sized home inspection businesses there may not be much of a distinction between the legal entity and what you entered as the business and primary contact information.

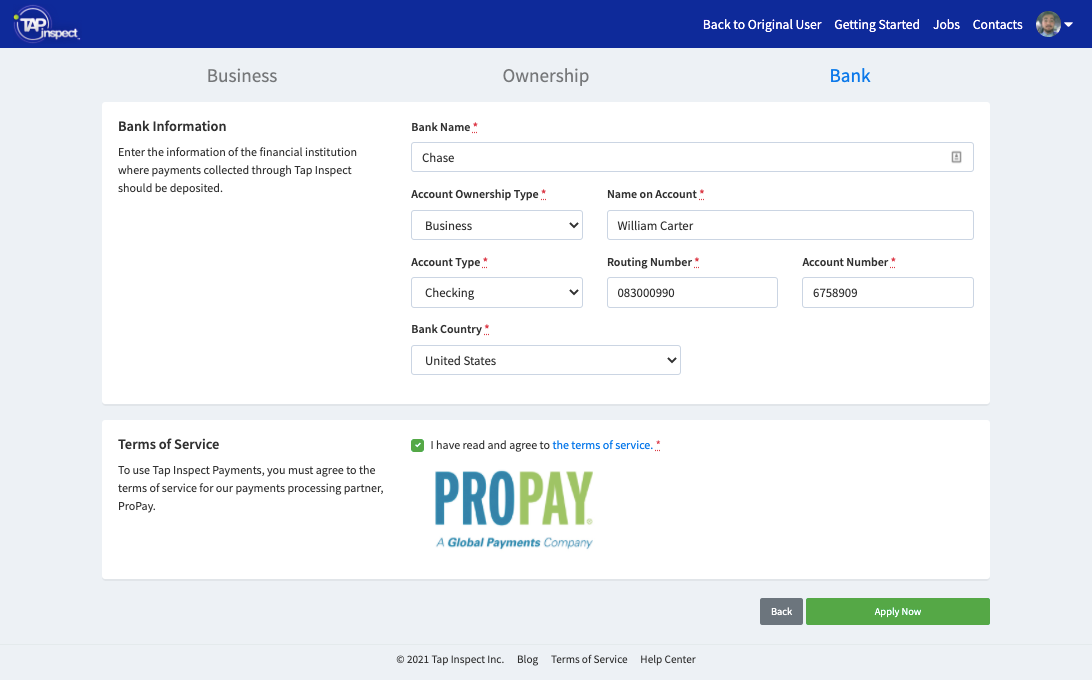

Bank & Terms of Service

Tell us where to deposit your client's payments. You will need to know your banking information such as your routing and account numbers.

Most applications only take a few moments to approve. In the rare event that your application is not approved or you receive an error please reach out to info@tapinspect.com and we will help.

Comments

0 comments

Please sign in to leave a comment.